Group Composite Depreciation Method

Group Composite Depreciation Method Assignment Help | Group Composite Depreciation Method Homework Help

Group And Composite Depreciation Method

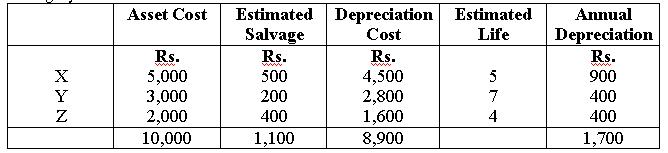

Sometimes asset of similar kinds with approximately similar useful economic life are combined rate of depreciation is applied. This process is known as group depreciation. If dissimilar assets are depreciated together, the process is called composite deprecation. The use of group or composite rate of depreciation eliminated the clerical work involved in computing periodic depreciation for individual pieces of equipment owned by the business. Moreover, there is no need for detailed records for accumulated depreciation on each machine. If group or composite depreciation methods are used, no gain or loss is recognized on sale or retirement of different units in a group. It is assumed that the unit has been fully depreciated. It further assumes that over-depreciation and under-depreciation charges offset each other. The simple entry to be passed on disposal is to credit the asset account and debit the accumulated depreciation account, as it is assumed that gains on sale of some assets are balanced by losses in others. The depreciation rate is computed as a weighted average; the weights being the money cost of the assets in each category. This is illustrated below:

The Composite Life for this group of assets is:

Depreciation cost/Annual Depreciation = 8,900/1,700 = 5.24 years

Assuming the use of straight line method…. or any other method…. the annual rate to be applied is:

Annual Depreciation / Total Cost = 1,700/10,000 = .17 or 17 %

The 17 % represents a mean average rate which when applied to total cost of Rs. 10,000 over 5.24 years accumulated Rs. 8,900 (rounded 17% x5.24 x 10,000), the cost to be depreciated. The annual depreciation charge is 1,700 (10,000 x 17%). The average rate is used until such time as purchases and disposals change relationship within the asset group – with respect to types of assets, estimates useful lives etc. – so as to make necessary the computation of a new group rate.

For more help in Group And Composite Depreciation Method click the button below to submit your homework assignment

The Composite Life for this group of assets is:

Depreciation cost/Annual Depreciation = 8,900/1,700 = 5.24 years

Assuming the use of straight line method…. or any other method…. the annual rate to be applied is:

Annual Depreciation / Total Cost = 1,700/10,000 = .17 or 17 %

The 17 % represents a mean average rate which when applied to total cost of Rs. 10,000 over 5.24 years accumulated Rs. 8,900 (rounded 17% x5.24 x 10,000), the cost to be depreciated. The annual depreciation charge is 1,700 (10,000 x 17%). The average rate is used until such time as purchases and disposals change relationship within the asset group – with respect to types of assets, estimates useful lives etc. – so as to make necessary the computation of a new group rate.

For more help in Group And Composite Depreciation Method click the button below to submit your homework assignment