Equilibrium In The Commodity Market

Equilibrium In The Commodity Market Assignment Help | Equilibrium In The Commodity Market Homework Help

Equilibrium in The Commodity Market

Commodity market deals with the sale of and purchase of goods. Equilibrium in the commodity market is attained when the aggregate demand for goods equals the aggregate supply or the total investment equals total swings.

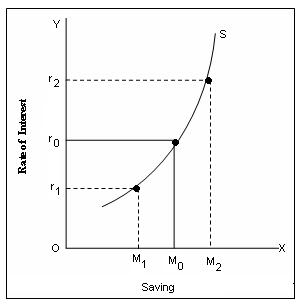

The Saving Function

The saving function (S) refers to the supply of capital or the aggregate supply. Saving is a function of rate of interest. There exists a positive relationship between the rate of interest and savings. At higher rate of interest, savings are more than at a lower rate of interest. The direct relationship between the rate of interest and saving.

In SS is the saving curve which slopes upwards to the right. At the rate of interest r0, saving is M( ). As the rate of interest rises to or2 , the savings also increase to OM2 . Conversely, a fall in the rate of interest to or1 causes a decrease in the saving to OM1.

In SS is the saving curve which slopes upwards to the right. At the rate of interest r0, saving is M( ). As the rate of interest rises to or2 , the savings also increase to OM2 . Conversely, a fall in the rate of interest to or1 causes a decrease in the saving to OM1.

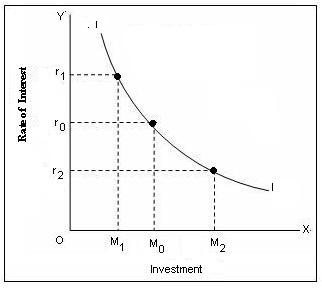

The Investment Function

The investment function (I) refers to the demand for capital or aggregate demand. investment is also a function of rate of interest. Rate of interest and investment are inversely related. At a high rate of interest, the demand for capital for investment is less than at a low rate of interest. The inverse relationship between rate of interest and investment.

In II is the investment curve. The downward slope of the II curve shows inverse relationship between the rate of interest and investment. At the rate of interest Or0 the demand for capital for investment is OM0. As the rate of interest rises to Or1, the investment falls to OM1. Conversely, if the rate of interest falls to OM1, the investment rises to OM2.

For more help in Equilibrium in The Commodity Market click the button below to submit your homework assignment

In II is the investment curve. The downward slope of the II curve shows inverse relationship between the rate of interest and investment. At the rate of interest Or0 the demand for capital for investment is OM0. As the rate of interest rises to Or1, the investment falls to OM1. Conversely, if the rate of interest falls to OM1, the investment rises to OM2.

For more help in Equilibrium in The Commodity Market click the button below to submit your homework assignment