Monetary Transmission Mechanism

Monetary Transmission Mechanism Assignment Help | Monetary Transmission Mechanism Homework Help

Monetary Transmission Mechanism

Let us now see how monetary policy works, i.e., how it affects aggregate demand, GDP and the price level.

Monetary policy works through what is called the transmission mechanism.

Transmission mechanism is the mechanism by which changes in monetary policy affect aggregate demand. The transmission mechanism works in two stages.

In stage one, changes in interest rates affect investment expenditure.

In stage two, changes in investment affect aggregate demand.

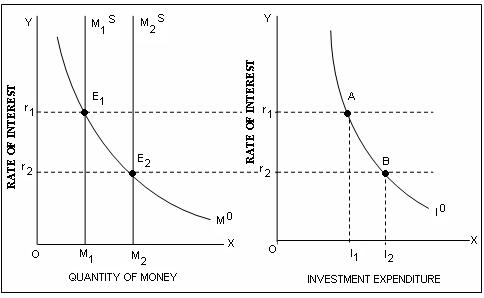

The link between the interest rate and the investment expenditure is shown in

is drawn in two panels. Panel (a) shown money demand and supply.

The original interest rate is r1; at this interest rate quantity demanded and supplied of money is equal at M1.

Suppose the monetary authority decided to reduce the interest rate to r2. They will have to buy all the extra bonds offered for sale at the new reduced interest rate; money supply in the economy will increase to M2. Market will be in equilibrium at the lower interest rate at r2.

Panel shows the investment function. At the original interest rate, r1, investment expenditure amounted to I1. Now, with more money available in the economy and lower interest rates, investment expenditure increases to I2. By joining points A and B, we get the investment demand function. The investment demand function demonstrates the inverse relation between interest rate and investment expenditure.

Monetary policy works through what is called the transmission mechanism.

Transmission mechanism is the mechanism by which changes in monetary policy affect aggregate demand. The transmission mechanism works in two stages.

In stage one, changes in interest rates affect investment expenditure.

In stage two, changes in investment affect aggregate demand.

Stage One : Investment Demand Function

Investment demand bears an inverse functional relation with the interest rate. Other things being equal, a decrease in the rate of interest makes borrowing cheaper and generates new investment expenditure.The link between the interest rate and the investment expenditure is shown in

is drawn in two panels. Panel (a) shown money demand and supply.

The original interest rate is r1; at this interest rate quantity demanded and supplied of money is equal at M1.

Suppose the monetary authority decided to reduce the interest rate to r2. They will have to buy all the extra bonds offered for sale at the new reduced interest rate; money supply in the economy will increase to M2. Market will be in equilibrium at the lower interest rate at r2.

Panel shows the investment function. At the original interest rate, r1, investment expenditure amounted to I1. Now, with more money available in the economy and lower interest rates, investment expenditure increases to I2. By joining points A and B, we get the investment demand function. The investment demand function demonstrates the inverse relation between interest rate and investment expenditure.

Stage two : Derivation of new aggregate demand curve

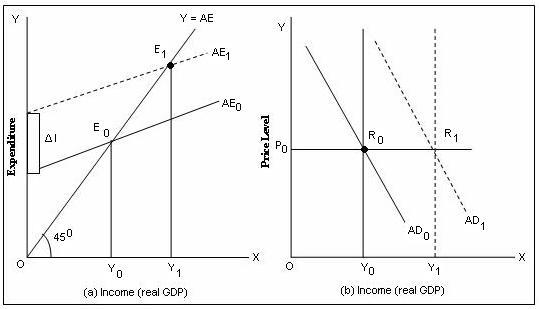

An increase in investment expenditure at a lower interest rate would result in an increase in the aggregate expenditure, and thus the aggregate demand curve will shift upwards. A new equilibrium will come to be established at a higher level of income.

This can be illustrated with the help.

After a fall in the rate of interest from r1 to r2 as shown in investment expenditure raises by ΔI, and as a result, aggregate expenditure curve AE1 shifts upwards to AE0, as shown in (a). Given the price level P0, the equilibrium point shifts from E0 to E1 causing a rise in GDP from Y0 toY1. In at the given price level P0, equilibrium is shown by point R0. Where at the aggregate demand curve AD0, the GDP IS Y0.

An increase in the investment expenditure by ΔI, equilibrium point shifts upwards from E0 to E1 and real GDP rises from Y0 to Y1, as shown in price level remaining unchanged at P0, a shift in aggregate expenditure curve AE0 to AE1 causes a rightward shift in the aggregate demand curve AD0 to AD1, as shown in. At the new equilibrium point R1, the real GDP rises from Y0 to Y1.

For more help in Monetary Transmission Mechanism click the button below to submit your homework assignment

This can be illustrated with the help.

After a fall in the rate of interest from r1 to r2 as shown in investment expenditure raises by ΔI, and as a result, aggregate expenditure curve AE1 shifts upwards to AE0, as shown in (a). Given the price level P0, the equilibrium point shifts from E0 to E1 causing a rise in GDP from Y0 toY1. In at the given price level P0, equilibrium is shown by point R0. Where at the aggregate demand curve AD0, the GDP IS Y0.

An increase in the investment expenditure by ΔI, equilibrium point shifts upwards from E0 to E1 and real GDP rises from Y0 to Y1, as shown in price level remaining unchanged at P0, a shift in aggregate expenditure curve AE0 to AE1 causes a rightward shift in the aggregate demand curve AD0 to AD1, as shown in. At the new equilibrium point R1, the real GDP rises from Y0 to Y1.

For more help in Monetary Transmission Mechanism click the button below to submit your homework assignment