Net Income Approach

Net Income Approach Assignment Help | Net Income Approach Homework Help

NET INCOME APPROACH

The Net Income (NI) approach to the relationship between leverage, cost of capital and value of the firm is the simplest in approach and explanation. As suggested by Durand, this theory states that there is a relationship between capital structure and the value of the firm and therefore, the firm can affect its value by increasing or decreasing the debt proportion in the overall financing mix. The NI approach make the following assumptions:

1) That the total capital requirement of the firm are given and remain constant.

2) That After tax cost of debt( k d ) is less than Cost of Equity ( k e ).

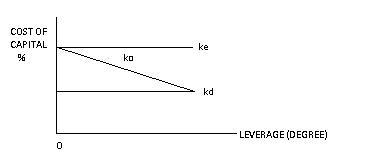

The NI approach starts from the argument that change I financing mix of a firm will lead to change in WACC, k o, of the firm resulting in the change in the value of the firm. As k d is less than k e, the increasing us of cheaper debt (and simultaneously decrease in equity proportion) in the overall capital structure will result in the magnified returns available to the shareholders. The increased returns to the shareholders will increase the total value of the equity and thus increases the total value of the firm. The WACC, k o, will decrease and the value of the firm will increase. On the other hand, if the financial leverage is reduced by the decrease in the debt financing, the WACC, of the firm will increase and the total value of the firm will decrease. The NI approach to the relationship between leverage cost of capital ha been presented graphically in fig.

The fig. shows that the k d and k e are constant for all leverage i.e., for all levels of debt financing. As the debt proportion or the financial leverage increases, the WACC, decreases as the k d is less than k e . This result in the increase in value of the firm. In the fig. it may be noted that the WACC will approach k d as the debt proportion increases. However, WACC will never touch k d as there cannot be 100% debt firm. Some element of equity must be there. However, if the firm is 100% equity firm, then the WACC is equal to k e. The rate of decline in WACC depends upon the relative position of k d and k e.

Under NI approach, the firm will have the maximum value capital structure at a point where WACC is minimized. With a judicious use of the debt and equity, a firm can achieve an optimal capital structure. This optimal capital structure is one at which the WACC, is minimum resulting in the maximum value of the firm.

For more help in Net Income Approach please click the button below to submit your assignment:

1) That the total capital requirement of the firm are given and remain constant.

2) That After tax cost of debt( k d ) is less than Cost of Equity ( k e ).

3) Both k d and k e remain constant and increase in financial leverage i.e., use of more and more debt financing in the capital structure does not affect the risk perception of the investors.

The NI approach starts from the argument that change I financing mix of a firm will lead to change in WACC, k o, of the firm resulting in the change in the value of the firm. As k d is less than k e, the increasing us of cheaper debt (and simultaneously decrease in equity proportion) in the overall capital structure will result in the magnified returns available to the shareholders. The increased returns to the shareholders will increase the total value of the equity and thus increases the total value of the firm. The WACC, k o, will decrease and the value of the firm will increase. On the other hand, if the financial leverage is reduced by the decrease in the debt financing, the WACC, of the firm will increase and the total value of the firm will decrease. The NI approach to the relationship between leverage cost of capital ha been presented graphically in fig.

The fig. shows that the k d and k e are constant for all leverage i.e., for all levels of debt financing. As the debt proportion or the financial leverage increases, the WACC, decreases as the k d is less than k e . This result in the increase in value of the firm. In the fig. it may be noted that the WACC will approach k d as the debt proportion increases. However, WACC will never touch k d as there cannot be 100% debt firm. Some element of equity must be there. However, if the firm is 100% equity firm, then the WACC is equal to k e. The rate of decline in WACC depends upon the relative position of k d and k e.

Under NI approach, the firm will have the maximum value capital structure at a point where WACC is minimized. With a judicious use of the debt and equity, a firm can achieve an optimal capital structure. This optimal capital structure is one at which the WACC, is minimum resulting in the maximum value of the firm.

For more help in Net Income Approach please click the button below to submit your assignment: